This is lower than the long term average of 418. Bonds issued by national governments in foreign currencies are normally.

Malaysian Government Securities Yields Up As Investors Price In Aggressive Rate Hikes By Global Central Banks Marc The Edge Markets

H15 Selected Interest Rates.

. Bills are sold at discount through competitive auction facilitated by Bank Negara Malaysia with original maturities of 3-month 6-month and 1-year. 3 Month Treasury Bill Rate is at 248 compared to 241 the previous market day and 005 last year. Risk premium on lending lending rate minus treasury bill rate in Malaysia was reported at 17733 in 2016 according to the World Bank collection of development indicators compiled from officially recognized sources.

High liquidity in secondary market. No credit risk as issued by the government. Malaysia - Risk premium on lending prime rate minus treasury bill rate - actual values historical data forecasts.

The Malaysia 10Y Government Bond has a 3960 yield. Current 5-Years Credit Default Swap quotation is 5719 and implied probability of default is 095. Treasury Bills and Bank Negara Bills.

Treasury Bills and Bank Negara Bills. Traded in multiples of RM10000. Discounted rate based on.

The redemption will be made at par. Central Bank Rate is 225 last modification in July 2022. Generally a government bond is issued by a national government and is denominated in the countrys own currency.

Normal auction day is Thursday and the results of successful bidders will be announced one day after on Friday. 156 Explore Preview Download Interest Rates. Condensed interest rates tables provide recent historical interest rates in each category.

Bank Negara Malaysia BNM Bank Negara Malaysia BNM read more. Knoema an Eldridge business is the premier data platform and the most comprehensive source of global decision-making data in the world. Malaysian Treasury Bills MTB MTB are short-term securities issued by the Government of Malaysia to raise short-term funds for Governments working capital.

Malaysian Treasury Bills MTB MTB are short-term securities issued by the Government of Malaysia to raise short-term funds for Governments working capital. The Malaysia credit rating is A- according to Standard Poors agency. Bills are sold at discount through competitive auction facilitated by Bank Negara Malaysia with original maturities of 3-month 6-month and 1-year.

Interest Rates Downloads. 21 rows Rates. Payable at face value on maturity.

The 3 month treasury yield hovered near 0 from 2009-2015 as the Federal Reserve maintained its benchmark rates at 0 in the aftermath of the Great Recession. Stay on top of current and historical data relating to Malaysia 3-Month Bond Yield. Instruments traded on the Malaysian bond market comprise conventional and Islamic papers which includes the following.

Malaysia Treasury Bills 244 274 298 Malaysia Islamic Treasury Bills 245 273. Issued by BNM on behalf of Government and traded on a discounted basis. 10-Year Malaysian Government Securities Tender Results for 14 September 2021.

MITB are usually issued on a weekly basis with original maturities of 1-year. As an additional resource we also provide summaries and links to recent interest rate related news. Malaysia 10Y Bond Yield was 395 percent on Wednesday August 10 according to over-the-counter interbank yield quotes for this government bond maturity.

Table 24 Data as at Sept 2018 Downloads. Malaysian Islamic Treasury Bills MITB MITB are short-term securities issued by the Government of Malaysia based on Islamic principles. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1 3 6 and 12 months.

364-Day Malaysian Treasury Bills Tender Result for 23 September 2021. Our revolutionary technology changes the way individuals and organizations discover visualize model and present their data and the worlds data to facilitate better decisions and better outcomes. Malaysian Treasury Bills MTB and Malaysian Government Securities MGS are short term and long term papers issued on conventional basis by the Malaysian Government to manage the economy.

On 25 March Bank Negara Malaysia announced the formation of the Malaysia Islamic Overnight Rate a new reference rate for Shariah-compliant financial products. The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity. Treasury Bills and Bank Negara Bills Popular.

Tenure less than one year.

13 Week Treasury Bill Irx Charts Data News Yahoo Finance

Bnm Says Malaysian Govt S Rm3 Billion Islamic Bonds To Be Issued On Jan 31 The Edge Markets

What Are Government Bonds How Do You Buy Them In Australia Ig Australia

Malaysia Discount Rate Treasury Bills 3 Months Economic Indicators Ceic

Malaysia Discount Rate Treasury Bills 12 Months Economic Indicators Ceic

Interest Rates Government Securities Treasury Bills For Brazil Intgstbrm193n Fred St Louis Fed

404 File Or Directory Not Found

Money Transfer Services Transfer Funds Axios Credit Bank

Interest Rates Government Securities Treasury Bills For Brazil Intgstbrm193n Fred St Louis Fed

Malaysia Government Securities Indicative Yield Ceic

13 Week Treasury Bill Irx Charts Data News Yahoo Finance

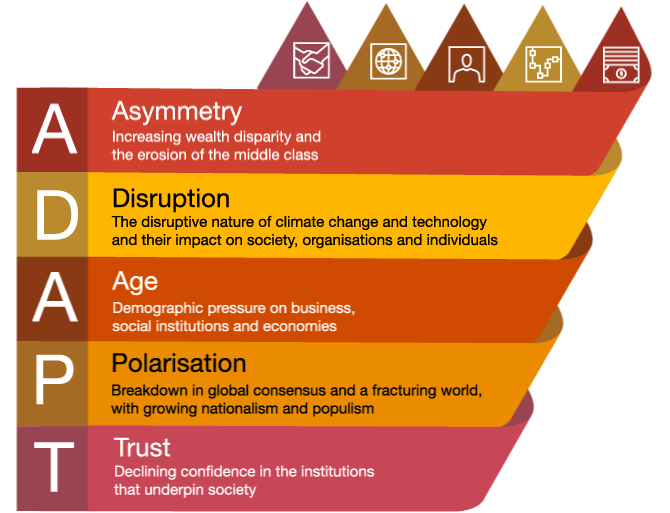

Adapt Five Global And Urgent Issues And Their Implications Economic Office Pwc

Global Payments 2021 All In For Growth Bcg

Fixed Income Outlook Hitting The Brakes At Least In The Us Bnpp Am Luxembourg Professional Investor

T Bills Information For Individuals

Treasury Bills Guide To Understanding How T Bills Work

High Bond Yields In Play The Star